Blog > What is an Earnest Money Deposit (EMD)?

When diving into the world of real estate, particularly in Florida, you’ll often encounter the term "Earnest Money Deposit" (EMD), also known as a good faith deposit. This crucial component of a real estate transaction can sometimes be confusing for buyers, especially those new to the process. Let's break down what an EMD is, why it's important, and how it fits into the broader scope of real estate contracts.

What is an Earnest Money Deposit?

An Earnest Money Deposit is a sum of money that a buyer offers to a seller as a sign of their serious intent to purchase the property. Think of it as a financial handshake—a gesture that shows you’re committed to following through with the transaction. In Florida, this deposit is typically held in an escrow account until the sale is finalized.

Why is EMD Important?

The primary purpose of an EMD is to provide security for both parties involved in the transaction. For sellers, it acts as a safeguard against buyers who might back out without valid reasons. For buyers, it demonstrates their commitment and can make their offer more attractive in competitive markets.

How Much Should You Offer?

The amount of an EMD can vary but generally ranges from 1% to 3% of the property’s purchase price. In some cases, particularly in hot real estate markets, sellers may request higher deposits. A good real estate agent can often negotiate a lower EMD if a buyer doesn't have a lot of money to spend out of pocket. It's essential for buyers to consult with their real estate agent to determine an appropriate amount.

Where Does the Money Go?

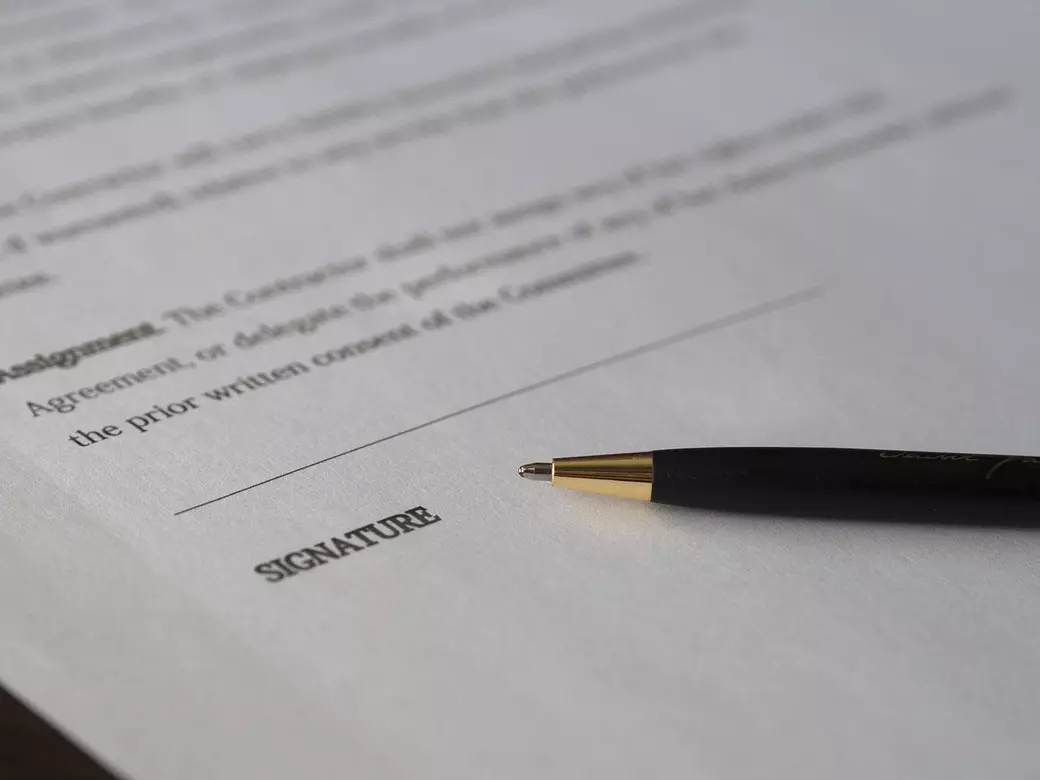

Once both parties agree on the terms and sign the contract, the EMD is deposited into an escrow account managed by a third party—often a title company or a real estate brokerage. This neutral party holds onto the funds until closing day when they are applied toward the buyer’s down payment or closing costs.

What Happens if the Deal Falls Through?

Life happens, and sometimes deals fall apart. The fate of your EMD depends on why and how the deal collapses:

- Contingencies: Most real estate contracts include contingencies—conditions that must be met for the deal to proceed. Common contingencies include financing approval, satisfactory home inspection, and appraisal value matching or exceeding the purchase price. If any contingency isn't met, buyers can usually reclaim their EMD without penalty. Buyer's can often back out of the contract and get their EMD back during their inspection or due dilligence period, if their agent negotiated the proper contingencies.

- Buyer Default: If a buyer backs out for reasons not covered by contingencies, they risk forfeiting their EMD to the seller as compensation for taking their property off the market.

- Mutual Agreement: Sometimes both parties mutually agree to cancel the contract. In such cases, they can negotiate how to handle the EMD.

**Legal Considerations

Florida law requires that all terms related to earnest money deposits be clearly outlined in writing within the real estate contract. Buyers should carefully review these terms and consult with their agent or attorney if they have any questions or concerns.

Final Thoughts

An Earnest Money Deposit plays a vital role in Florida real estate transactions by providing financial assurance and demonstrating buyer commitment. Understanding its function and implications can help you navigate your home-buying journey more confidently.

Whether you're a first-time buyer or seasoned investor, knowing how EMDs work will empower you to make informed decisions and potentially secure your dream property with greater ease. Always remember to read your contract thoroughly and seek professional advice when needed—after all, buying a home is one of life's most significant investments!